Crypto 101: How Bitcoin Became the Decade’s Best Asset—and What It Means for You

Risks, Rewards, and Why Ignoring It Is the Biggest Risk

Dear investors,

Today we’re gonna take a look at something a bit less boring than usual: the old crypto chat. BTC has been making new all time highs as of late and it’s probably time to have a look at the underlying technology.

Before we start: please note that I have been dabbling in the crypto-sphere since 2020 and have learnt some harsh lessons (losing over $6000 to the Celsius exchange bankruptcy after the FTX debacle.) I have also enjoyed average returns of 291% over the past year so I can advocate for both the good and the bad.

A screenshot of my Ledger Wallet for the sake of transparency. 17 November 2024.

We got Insta & FB! Have a look 👀

I have compiled a Spotify playlist of my favourite Bitcoin podcasts. You’re welcome.

Spotify Playlist : BTC Pods

BTC Background:

In 2008, amidst the chaos of a global financial crisis, an anonymous figure (or group) operating under the pseudonym Satoshi Nakamoto published a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This wasn’t just a new form of currency; it was a revolution.

Bitcoin offered a decentralized alternative to traditional financial systems, one where individuals could transact directly without relying on banks or governments. At its core was blockchain technology—a public ledger ensuring transparency and security. But what really set Bitcoin apart? Its finite supply. Only 21 million bitcoins will ever exist. Compare that to fiat currencies, which can be printed endlessly, diluting their value over time.

Fast forward to today, and Bitcoin has become the best-performing asset of the past decade. From its humble beginnings as an obscure experiment worth pennies, it has grown into a trillion-dollar asset class (at its peak) and a potential hedge against inflation.

Why Bitcoin Has Outperformed Everything

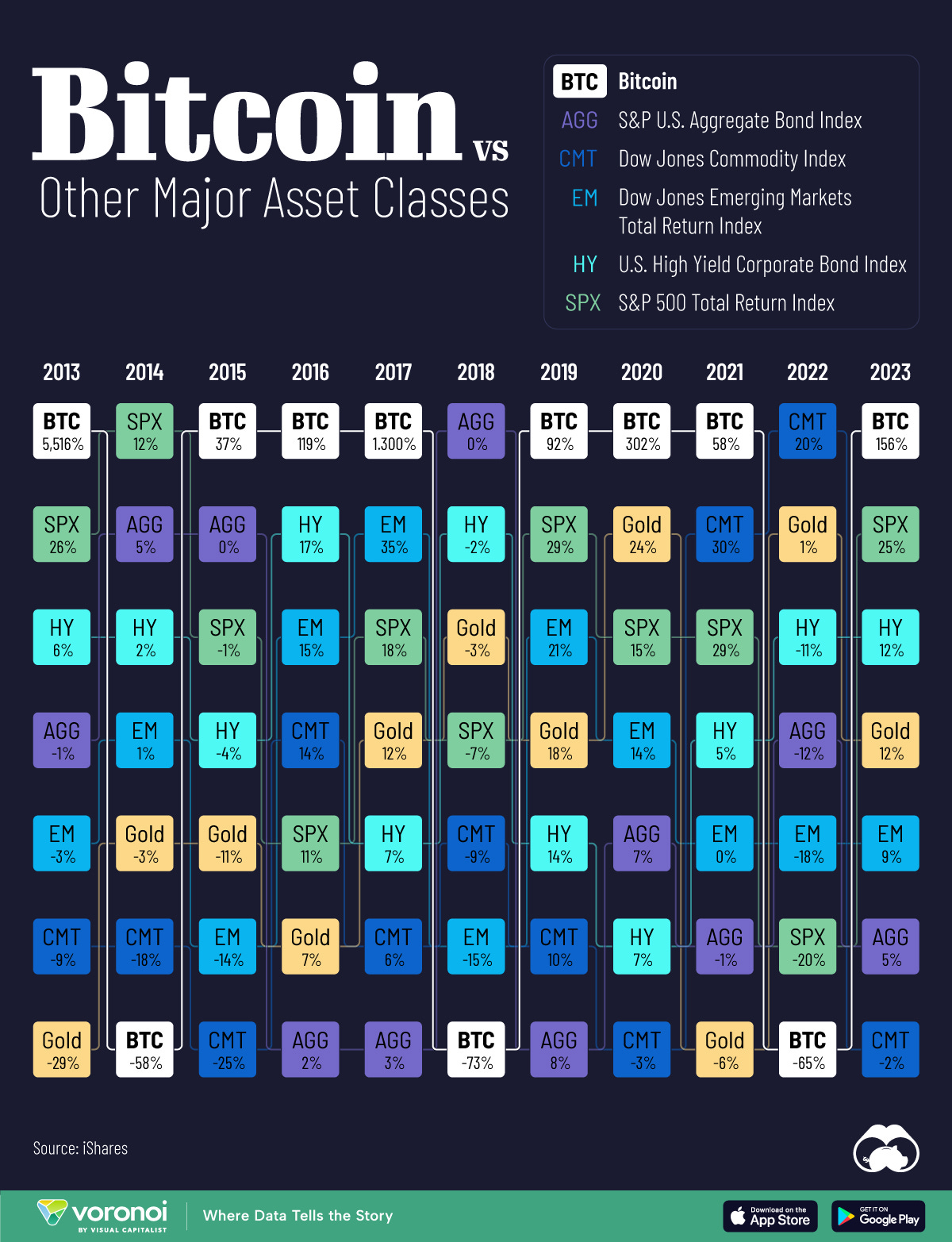

Let’s talk numbers. From 2011 to 2023, Bitcoin’s annualized return is approximately 200%. In contrast, the S&P 500 has delivered around 12% annually in the same timeframe. Gold? A meager 1-2%.

Here’s why Bitcoin has done so well:

Network Effects: Bitcoin’s adoption grows exponentially as more individuals, institutions, and even countries (hello, El Salvador!) recognize its value.

Finite Supply Meets Growing Demand: As more people want Bitcoin, the limited supply drives up its price.

Decentralized Innovation: Unlike traditional systems, Bitcoin evolves through its community and developers, adapting without central control.

Bitcoin isn’t just an investment; it’s a bet on a future where money is decentralized, borderless, and inflation-resistant.

But What About the Risks?

While Bitcoin’s upside is enticing, it’s crucial to understand the risks before jumping in. Here are the biggest pitfalls:

Volatility:

Bitcoin’s price is notoriously volatile. It’s not uncommon for BTC to lose 30-50% of its value in a matter of days. Over the years, Bitcoin has experienced multiple 80% drawdowns, testing the patience of even the most seasoned investors.The key? See volatility as the price of admission for long-term gains. Historically, Bitcoin has rebounded stronger after every crash.

Exchange Scams and Hacks:

FTX, Mt. Gox, Celsius, Voyager etc etc etc—the crypto world is littered with stories of exchanges collapsing and users losing everything. The golden rule? Not your keys, not your coins.Always transfer your Bitcoin to a hardware wallet like Ledger or Trezor. These devices allow you to store your crypto offline, safe from hackers.

Use this link order your hardware wallet to get $30 free BTC:

Leverage Can Wipe You Out:

Many investors have been tempted to use leverage (borrowing to amplify gains) in the hope of striking it rich. But Bitcoin’s volatility means that leveraged positions can easily be liquidated during market swings.My advice? Avoid leverage at all costs. Crypto is already high-risk; don’t make it riskier.

The “Don’t Fuck This Up” Thesis

Raoul Pal, a former hedge fund manager and vocal Bitcoin advocate, sums up his investment thesis in simple terms: The risk of not owning Bitcoin outweighs the risk of owning it.

Here’s why:

Bitcoin represents an asymmetric bet. The downside is losing 100% of your investment (if Bitcoin goes to zero), but the upside is potentially 10x, 50x, or more over the coming decades as adoption grows.

Even a small allocation to Bitcoin can have a disproportionate impact on your overall portfolio.

Pal’s advice resonates with me. I view Bitcoin as a small but critical part of my portfolio, maintaining around 20% of my liquid equity in crypto. If the value of my crypto holdings grows beyond that, I take profits—what I call my “lifestyle chips.” These are gains I use to fund meaningful experiences or investments in my personal life, while keeping the bulk of my portfolio balanced.

Bitcoin for Yacht Crew: A Perfect Fit

As yacht crew, we live unique lifestyles, often working internationally and earning in strong currencies. Bitcoin aligns well with our needs:

Borderless: Whether you’re in Monaco, Antigua, or Miami, Bitcoin goes wherever you go.

Inflation Hedge: If you’re saving in fiat currencies, inflation eats away at your purchasing power over time. Bitcoin’s capped supply makes it a potential hedge.

Asymmetric Returns: Even small, consistent investments can yield outsized rewards over the long term.

However, Bitcoin isn’t a get-rich-quick scheme. Success in crypto comes from patience, discipline, and education.

How to Get Started Safely

Educate Yourself: Read books, watch videos, and follow credible Bitcoin experts like Raoul Pal, Andreas Antonopoulos, or Lyn Alden.

Start Small: Don’t invest more than you’re willing to lose. Even 1-5% of your portfolio can be a game-changer.

Secure Your Investment:

Use reputable exchanges like eToro, Coinbase or Kraken to buy Bitcoin.

Immediately transfer your coins to a hardware wallet for safekeeping.

Think Long-Term: Forget about day trading. Bitcoin rewards those who hold through volatility.

Bonus: Altcoins—The High-Risk, High-Reward Gamble

While Bitcoin is the undisputed leader in the crypto world, it’s just the tip of the iceberg. Beyond BTC lies a vast sea of altcoins & memecoins—cryptocurrencies that serve different purposes and boast varied risk profiles. Some well-known altcoins include:

Ethereum (ETH): Known as the “world computer,” Ethereum enables smart contracts and decentralized applications (dApps). It’s the backbone of innovations like DeFi and NFTs.

Solana (SOL): A fast, low-cost blockchain competing with Ethereum in the smart contract space. Its focus on scalability has earned it the nickname “Ethereum killer.”

Sui (SUI): A newer blockchain aiming to revolutionize Web3 user experiences with faster and more efficient infrastructure.

Altcoins like these can offer returns that dwarf even Bitcoin’s meteoric rise. However, they come with substantially more risk.

Why Altcoins Are Riskier

Unproven Technology: Many altcoins are experimental and may not survive long term. Think of the hundreds of projects that launched in 2017 only to disappear by 2020.

Higher Volatility: While Bitcoin’s volatility is high, altcoins can see even sharper price swings, sometimes losing 90% of their value in a bear market.

Regulatory Uncertainty: Governments worldwide are still figuring out how to classify and regulate altcoins, leading to potential legal risks.

My Altcoin Strategy

I allocate 20% of my crypto portfolio to altcoins like ETH, SOL, and SUI. I see this as my “casino money”—funds I’m willing to lose entirely for the chance of outsized gains. This part of my portfolio feeds my inner degenerate, allowing me to speculate on projects that excite me while keeping my core strategy intact.

Here’s how I approach it:

Stick to the Leaders: My primary focus is on projects with strong ecosystems and track records, like Ethereum and Solana.

Smaller Bets on Newcomers: I allocate a smaller portion to promising but unproven players like Sui, recognising the potential for both massive returns and total loss.

Never Over-Allocate: This is pure speculation. The bulk of my crypto portfolio remains in Bitcoin, the foundation of the digital asset world.

Final Thoughts

Whether it’s Bitcoin or altcoins, crypto offers a unique opportunity for outsized returns. But as always, discipline and strategy are key. Bitcoin is your anchor—the asset with the most proven track record and asymmetric potential. Altcoins? They’re the moonshot bets that could skyrocket or burn up entirely.

For yacht crew navigating the waters of investing, a small, disciplined allocation to Bitcoin and selective altcoins could unlock significant opportunities. But remember: crypto isn’t just about numbers—it’s about understanding the game and playing it smart.

P.S. Don’t forget to take those “lifestyle chips” when the opportunity arises. Your future self will thank you.

That’s it for this week- reach out if you want to dive deeper into the topic. Not an expert- but happy to help!