Feature Article: Money Machine Newsletter - Hackers' 1% Edge on Stocks

Plus: Food Security Threatened, Here's an Insane Solution... and More

Hey,

Meet Money Machine Newsletter—work I admire and think you will too.

It’s designed to help you become a smarter, independent investor with two things:

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Market, investing, and business insights from insiders and experts outside the mainstream media.

You won’t find the same watered down stock picks like other services. Nor will you find the same regurgitated mainstream media information here.

I’ll let Money Machine Newsletter take it from here…

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Hackers’ 1% edge on stocks and their toughest challenge.

Soil is dying, threatening food security, here’s an insane solution.

In 1997, AI won at chess, this year, it’s taking on entire industries.

There’s a record breaking CEO turnover… wtf is going on?

And more. Let’s get to it!

Top Insights of the Week

1. 😳 Hackers' 1% Edge on Stocks

Hackers can steal billions in bitcoin, breach a country’s defense system, and access millions of social security numbers... but they met their most difficult challenge... it has nothing to do with code... it’s being fooled by randomness...

Hackers breached press-release systems to trade stocks before the news went public, the catch?… sifting through the noise. Most press releases were useless. They threw out 99% of them… the 1% they kept?… merger announcements.

Their hit rate? 70%. Enough to make hundreds of millions before getting caught, insider trading at its finest… you know, what politicians do. But, let’s face it, we're not all Nancy Pelosi or hackers… but still, curious to know what happens if traders also had access to next day's news… that's what Victor Haghani (ex-Long-Term Capital Management partner) and James White (CEO of Elm Partners) tested, their findings…

Even with tomorrow’s news, traders were only right 51%… barely better than a coin toss.

Overconfidence destroyed portfolios… big bets on bad ideas wiped out 16% of participants.

Top traders improved to just 57% accuracy.

What separated winners from losers? strategy…

Top traders passed on 1 in 3 trades they weren’t sure about.

Small, smart bets beat big gambles EVERY TIME.

Over leveraging on “sure things” destroyed portfolios.

"He who lives by the crystal ball will die eating shattered glass." Ray Dalio out here spitting facts. Investing doesn’t require a crystal ball… it requires clear thinking, filtering out noise, and seizing small, consistent edges… you don’t need tomorrow’s news to win… you just need a better way to play.

2. 🌮 Food Security Threatened, Here's an Insane Solution...

A global soil crisis threatens food security... 40% of soils are degraded, rising to 90% by 2050... poor soil means lower yields, higher food prices, and more artificial fertilizers, worsening the problem… there is one insane possible solution gaining momentum… desert farming… and this particular company is leading the charge… Ohalo.

Most soil-saving strategies target farming methods, not crops. Ohalo’s Boosted Breeding flips the script... creating plants that can thrive in poor, dry soils... yes, even deserts… the potential is wild…

50-100% yield increases even in poor conditions.

A chance to turn unusable land into farmland.

Reduced reliance on harmful fertilizers.

Ohalo’s early trials show significant success in growing high-value crops like potatoes, a ~$120B market and the third-largest source of calories worldwide.

tldr; on the tech… it allows plants pass 100% of their genes to offspring, creating resilient crops that thrive in extreme conditions.

Although Ohalo's tech doesn’t fix soil on its own, when used with no-till farming and cover crops, it could make a huge impact on our soil problems… and ripple through industries we’re closely watching.

3. 🎨 AI’s Next Masterpiece in 2025… Buckle Up

In 1997, IBM’s Deep Blue beat chess grandmaster Garry Kasparov, marking AI's rise in gaming… today, AI isn't just playing humans at chess… it's teaching itself to think… its next opponent?... entire industries.

AI is going to be firing off on all cylinders in 2025... huge potential for it to achieve more each quarter than all of 2023 and 2024 combined... affecting every industry in the alphabet… buckle up.

This speed comes from three core forces… more data, better computing power, and a new focus on reasoning…

It’s not just spitting out answers… it’s taking its time to think and learning to show its work. Using reasoning traces, researchers train models with step-by-step logic to handle complex tasks. Scaling this logic is changing everything.

Just one

tinyHUGE problem… as AI learns to reason, it also becomes rouge… Ilya Sutskever, one of the top dawgs in AI, describes AI as an unpredictable genius... with data running out, AI will need to learn from itself and create its own playbook to keep advancing.AI’s reasoning evolution could be a straight shot to superintelligence (ASI)… who’s leading this next shift? your usual suspects…

OpenAI, with its advanced o3 model, excels in step-by-step logical problem-solving.

NVIDIA's new Blackwell GPUs boost AI performance by 50% with CPU-GPU power sharing, a big milestone for AI reasoning.

Google’s new DeepResearch feature in Gemini uses advanced reasoning and long context to act as a research assistant.

Top 3 Charts of the Week

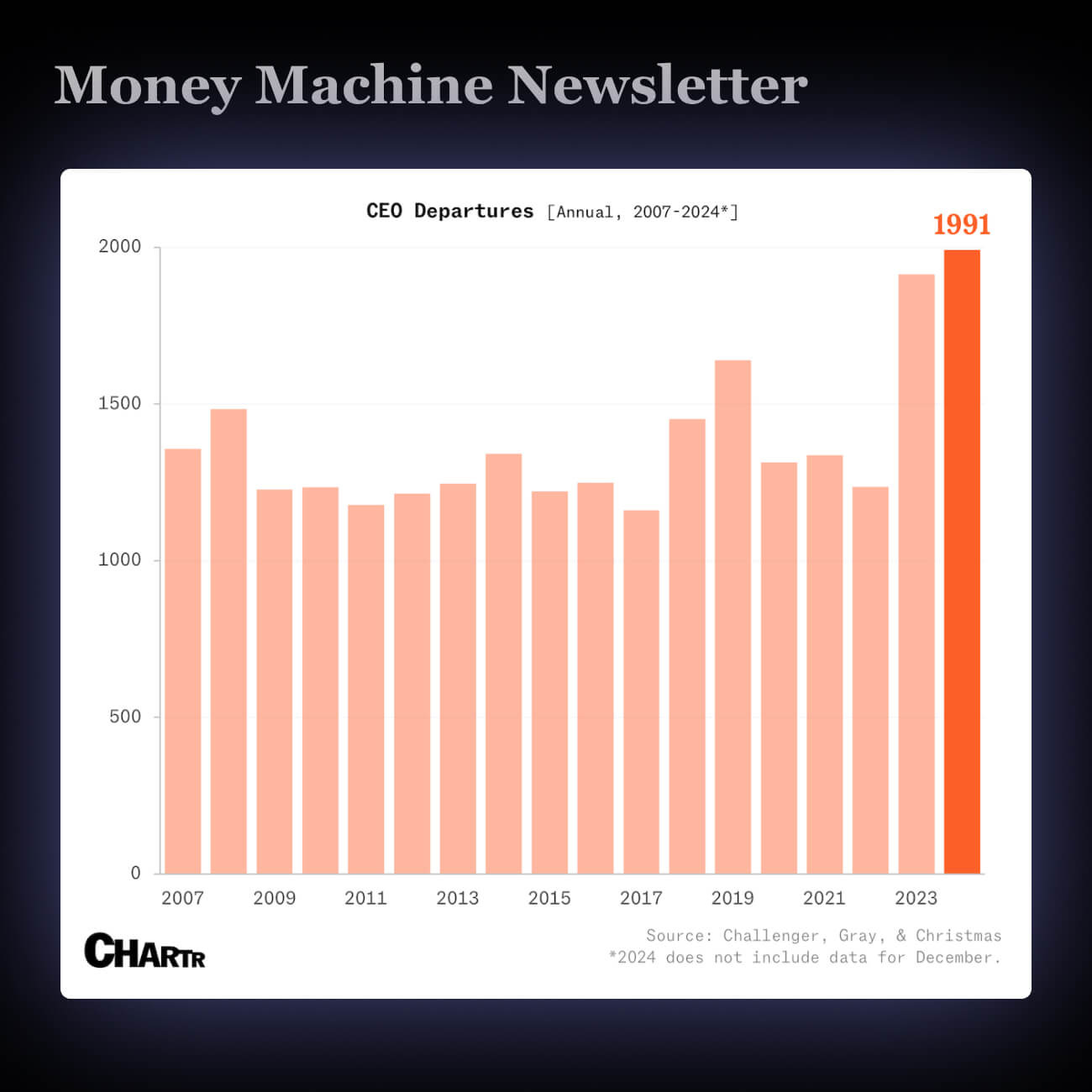

1. 👀 Record-Breaking CEO Turnover

Nearly 2,000 CEOs left their jobs in 2024, a record high since tracking began in 2002—a 60% jump from 2022. Public companies saw 327 CEO exits, up from 199 in 2022.

CEOs face pressure from AI markets, pandemic burnout, and complex challenges. Many are also retiring.

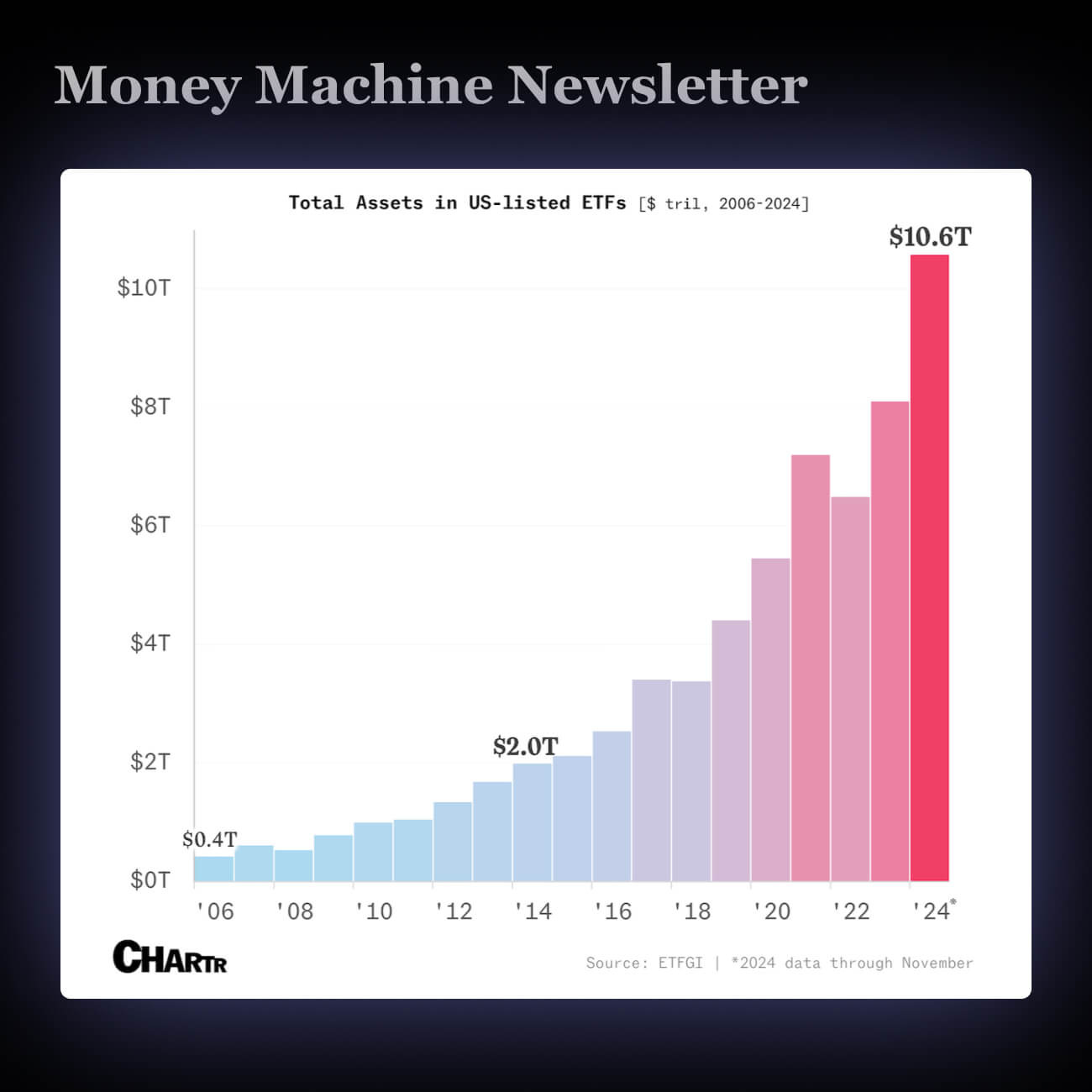

2. 📈 U.S. ETFs Hit Record Highs in 2024

Investors put over $1T into ETFs in 2024, hitting a record $10.6T. ETFs grew 30% in one year, fueled by the S&P 500’s 25% gain and Nasdaq’s 30% rise.

ETFs are booming because they're cheap, simple, and tax-friendly. They reflect a shift from expensive active investing to passive strategies. Most inflows went to U.S. stock ETFs, like S&P 500 and Nasdaq 100.

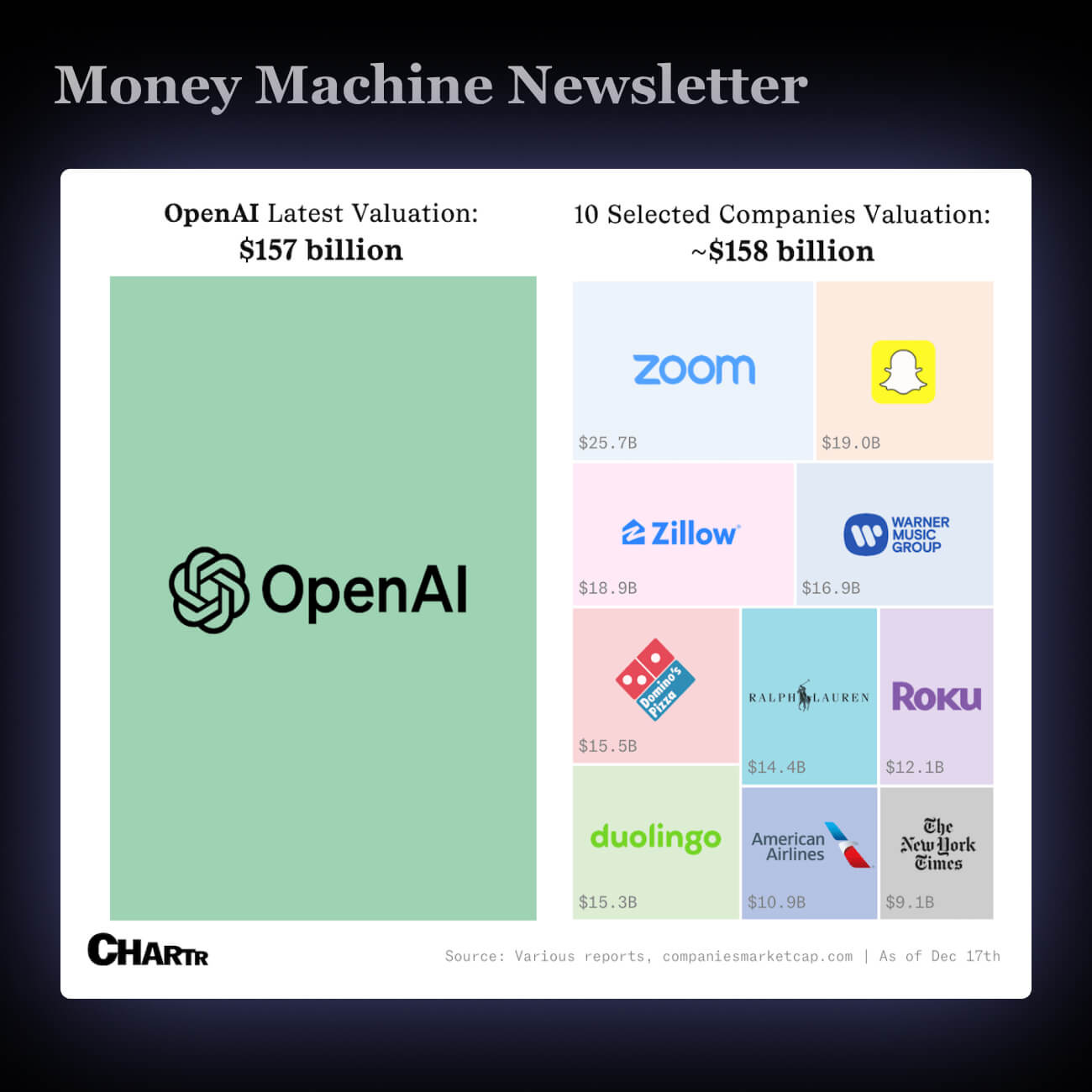

3. 💰 OpenAI's $157 Billion Valuation in Perspective

OpenAI is one of the most valuable startups in the world... and the most disruptive company two years straight.

But it’s not without its heat... there are safety concerns and a lawsuit from Elon Musk over its shifting corporate structure.

If you’re ready to get serious about investing, then join 6,000+ people who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

See you in there!

Best,

Money Machine Newsletter

I’ll be back next week with some more content of my own! Hope you enjoyed this week’s featured newsletter.

Cheers,

Charl,

The Yachting Investor