The Freedom Number: Hanging Up the Chamois for Good!

How Much Do You Need to Quit Yachting and Live the Dream?

Dear readers,

Before we dive in: check out our full website & service catalogue

Ahoy yachties! Have you ever dreamed of stepping off the gangway for the last time and into a life of complete financial freedom? Whether it’s starting a business, traveling the world, or simply enjoying a slower pace of life on land, achieving that goal starts with one key figure: your Freedom Number.

What Is a Freedom Number?

Your Freedom Number is the amount of money you need to sustain your ideal lifestyle without relying on a paycheck. It’s essentially your financial independence target—enough to cover your expenses indefinitely through investments, passive income, or savings.

Step 1: Define Your Ideal Lifestyle

Start by painting a clear picture of what life post-yachting looks like. Ask yourself:

Where will you live? (City vs. countryside, local vs. abroad)

What will you do with your time? (Work part-time, travel, hobbies, family)

How much does your ideal lifestyle cost?

Let’s say you’re aiming for a comfortable life in Florida with an annual budget of $60,000.

(DISCLAIMER: There are multiple factors that might make this number sound silly. It is only for easy math purposes and you should adjust to your needs accordingly!)

Step 2: Calculate Your Freedom Number

Example A: Freedom Number for Full Retirement

The simplest way to calculate your Freedom Number is using the 4% Rule, a common guideline in the financial independence community. It assumes you can safely withdraw 4% of your investment portfolio annually without depleting it.

Freedom Number = Annual Expenses ÷ 0.04

Using the $60,000 example:

$60,000 ÷ 0.04 = $1,500,000

You’ll need $1.5 million invested to sustainably generate $60,000 per year.

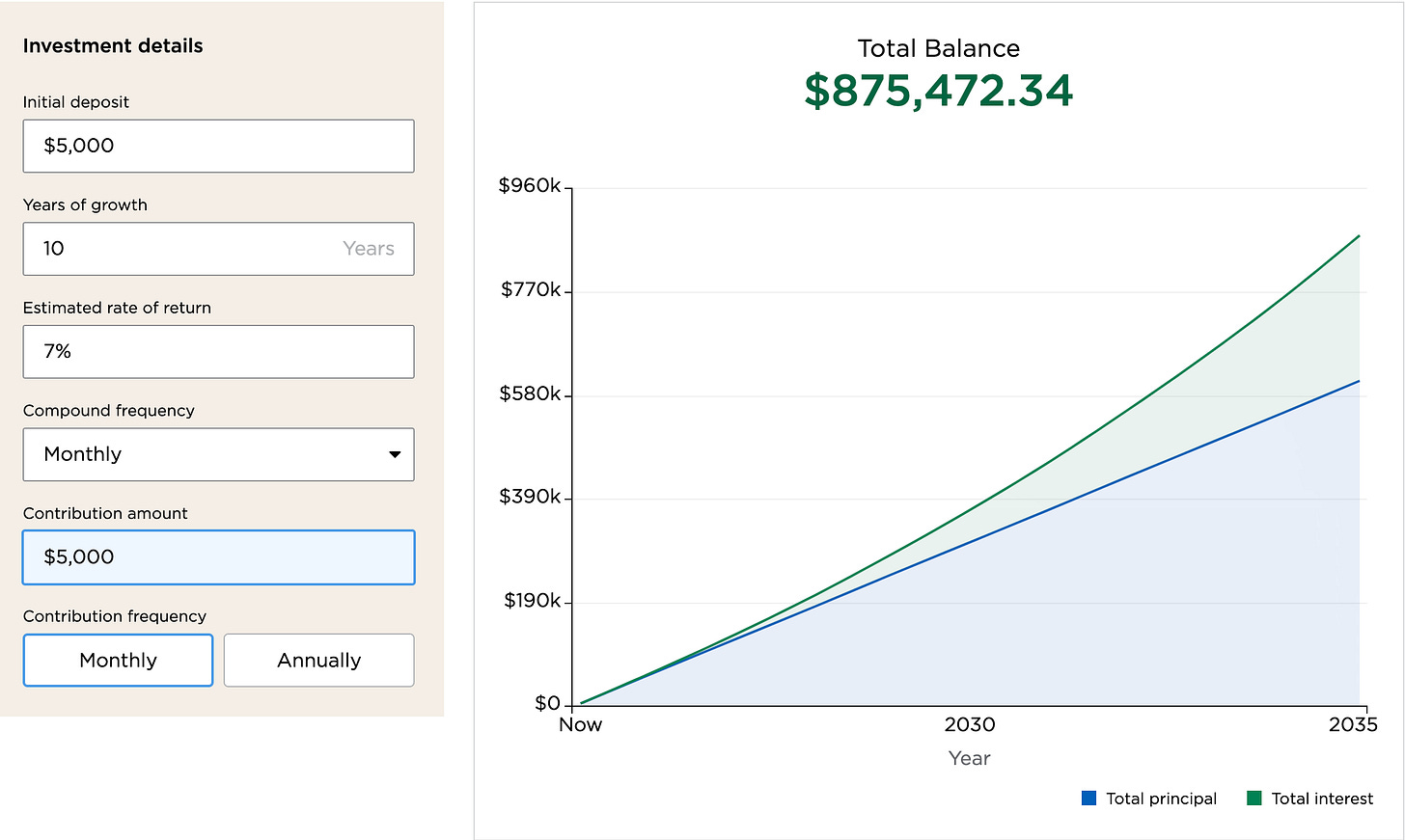

BONUS: Play around with a Retirement Calculator

Example B: Freedom Number for Part-Time Retirement

Here’s the good news: your Freedom Number doesn’t have to feel overwhelming if you plan to keep some income streams flowing. By factoring in part-time work, side hustles, or even seasonal gigs, you can reduce the amount of investments needed.

Let’s say you’re planning to work part-time, earning $25,000 per year:

Adjusted Expenses = $60,000 - $25,000 = $35,000

New Freedom Number = $35,000 ÷ 0.04 = $875,000

With this approach, you’d only need $875,000 invested to achieve financial freedom while maintaining some level of work that you enjoy.

This strategy allows you to transition gradually, easing the pressure and giving you more flexibility in how you live your dream.Step 3: Adjust for Your Situation

Everyone’s financial plan is unique, so adjust your number based on:

Additional Income: Do you plan to work part-time or have rental income? Deduct that from your annual expenses.

Healthcare Costs: Factor in health insurance and unexpected medical expenses.

Taxes: Account for taxes on your withdrawals or other income streams.

Inflation: Remember, costs will rise over time. Build in a cushion for inflation.

Step 4: Create a Savings Plan

Once you know your Freedom Number, it’s time to reverse-engineer your savings strategy. Here’s how:

Calculate Your Gap: Subtract your current savings and investments from your Freedom Number.

Example: $1.5M - $500K = $1M gap

Set a Timeline: Decide when you want to reach financial independence.

Example: 10 years

Determine Monthly Savings: Use an investment calculator like this one on Nerd Wallet to figure out how much you need to save and invest monthly to close the gap. Assume a realistic annual return (e.g., 7% after inflation).

Example: Around $5,000/month for 10 years at 7% returns.

Step 5: Invest Wisely

To reach your goal, your money needs to work as hard as you do:

Diversify: Spread investments across stocks, index funds, real estate, Bitcoin

and other assets.

Focus on Low Fees: Minimize costs with ETFs or index funds.

Automate: Set up automatic contributions to your investment accounts to stay consistent.

Step 6: Build Passive Income Streams

Consider creating income sources that support your freedom lifestyle:

Rental properties

Dividends from investments

A side hustle or small business

Step 7: Stay Flexible

Life changes, and so will your Freedom Number. Reassess your plan annually and adjust as needed. The key is to stay committed and adapt to new circumstances.

Final Thoughts

Your Freedom Number isn’t just a financial milestone—it’s the ticket to your dream life beyond yachting. By planning ahead, staying disciplined, and making your money work for you, you can turn the dream of financial independence into reality.

Start crunching the numbers today, and you’ll be one step closer to saying, “Anchors away!” for good.

Buoy’s , Balance & Banter

Your weekly dose of ideas to keep you steady, inspired, and smiling—whether you're charting your financial future or just riding the waves.

Good Read of the Week

📖 Article: 20 Lessons from 20 Years of Managing Money

Description: Ben Carlson shares 20 key lessons from his two decades in investment management, emphasizing that personal experiences shape risk perception, emotional intelligence often outweighs academic intelligence in investing, and that while long-term returns are crucial, navigating short-term challenges is essential.

Words to Live By

💡 Quote: “Wealth consists not in having great possessions, but in having few wants.” – Epictetus

Just for Laughs

😂 Video: Squidly in Jamaica

I watched this about 45 times during my lunch break and cracked every time.