Dear yachties & investors,

I am currently on a 6 week charter and was again reminded on how fucking time consuming it can be working on a yacht.

That’s why, this week, we’re diving into why buying and holding index funds is one of the smartest, simplest ways to grow your wealth. Forget the myth that you need to be a stock-picking genius or spend hours studying financial reports. Instead, let’s explore how “index fund and chill” can be your ticket to long-term financial success.

Visual representation of me chilling under a palm tree as my index fund investment grows. Circa 2023

FREE COURSE:

My friend Alex from The Money Dock has created a FREE COURSE on investing basics for readers of The Yachting Investor. Give it a go!

Why Index Funds Work for Most People

The S&P 500 Does the Work for You

The S&P 500, one of the most popular index funds, automatically flushes out underperforming companies and replaces them with rising stars. It’s like having a personal trainer for your investments, constantly keeping your portfolio in shape without you lifting a finger.Most Pros Can’t Beat the Market

Research shows that 95% of professional money managers fail to outperform the market over time. If the so-called experts can’t beat it, why not just buy the market itself?Lower Fees, Higher Gains

Traditional mutual funds come with hefty fees that eat into your profits. Index funds have ultra-low fees, so more of your money stays invested and grows over time.Set It and Forget It

Index funds rebalance themselves. You don’t need to constantly monitor them or make stressful decisions. They contain some of the biggest and best companies and even pay you dividends!

Why Simplicity Wins

Warren Buffett himself recommends index funds:

"Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time."

And let’s not forget Einstein’s take on compound interest:

"Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t, pays it."

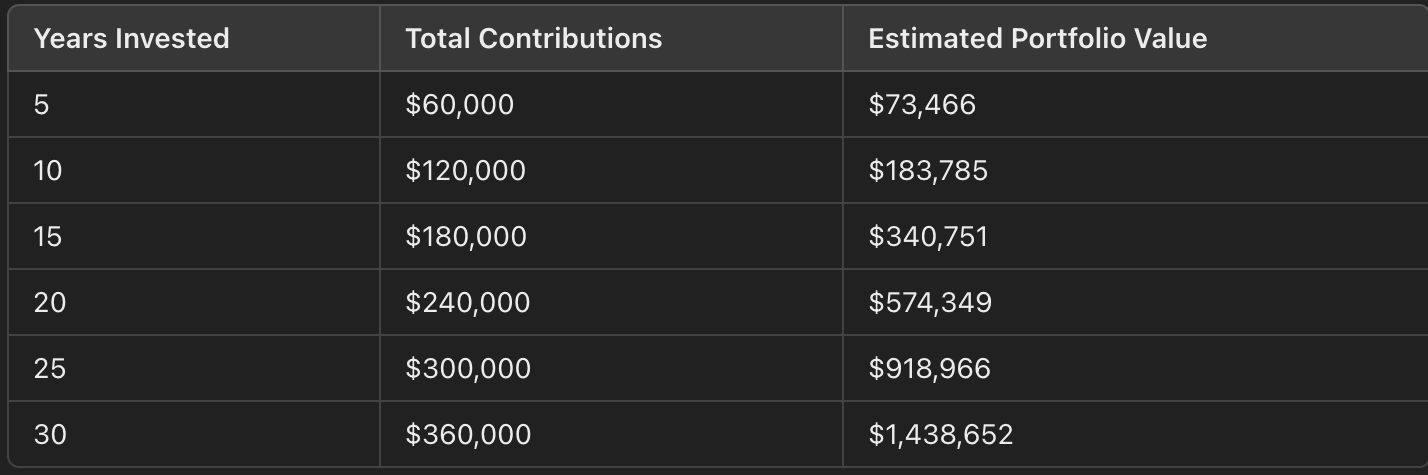

The Power of Compounding: What $1,000 per Month Can Do

Here’s a look at how investing $1,000 monthly in the S&P 500 could grow over time, assuming an 8% average annual return (historically realistic for the U.S. stock market):

Why Compounding Starts Slow but Ends Parabolic

At first, watching your portfolio grow may feel underwhelming. However, compounding is like pushing a snowball uphill. In the early years, the growth seems slow because your returns are building off a small base. But as your portfolio grows, the returns start generating returns of their own.

By year 15 in the table, your portfolio more than doubles what you invested, and by year 30, your $360,000 contributions turn into nearly $1.44 million! That’s the power of compounding: slow at first but exponential in the long run.

VIDEO EXAMPLE OF COMPOUND INTEREST AT WORK

How Have the Markets Been Doing?

The S&P 500’s average annual return since its inception is about 10%. Even with market dips and crashes, it’s consistently bounced back, rewarding those who stayed invested. For example, in 2023, the S&P 500 returned 28.09%, a testament to its resilience. As of 08 December 2024, the S&P has returned 27.68% already this year- a truly remarkable run!

THE YACHTING INVESTOR WEBSITE IS LIVE

Get Started Today

Open a Brokerage Account

Platforms like Vanguard, Fidelity, or Schwab are US yacht crew-friendly, with low fees and international access. South Africans can make use of eToro or EasyEquities.Automate Your Investments

Set up a recurring deposit into an S&P 500 index fund. Even if it’s just $100 a month, consistency is key.Stay the Course

The markets will go up and down, but remember: it’s time in the market, not timing the market, that builds wealth.

Final Thought

If you’re holding cash, it’s losing value to inflation. Instead, park your savings in a high-yield savings account for emergencies and funnel the rest into an index fund. Over time, your money will work harder for you than you ever could for it.

It’s time to “index fund and chill” while your wealth grows, just like your career at sea!

Anchors aweigh on your financial journey!

High yield savings account…if only there was one these days!